2024 Market Outlook

By: John Weitzer, CFA, SVP and Chief Investment Officer

and First Command's Investment Management Team

Jan 10, 2024 | 18 min. read

A Year in Review

The Market Outlook is our annual practice of reflecting on the year that just ended and sharing our expectations for the year ahead. In line with this tradition, we will begin with a review of several key economic and financial market metrics over the last five years:

Through this high-level lens, 2023 turned out to appear almost…average. In fact, it felt as if normalcy was reintroduced to markets and the economy after a tumultuous few years of lingering pandemic restrictions and their fallout.

However, the general sentiment entering the year was anything but normal. Even as COVID-19 was fading into yesterday’s news in the United States, many foreign countries were only just attempting to reestablish a sense of normalcy. China, for example, had just abandoned its “zero-tolerance” policy in December of 2022, and other nations were just beginning to relax various travel restrictions. Beyond the pandemic, the Ukrainian conflict continued to rage and was expected to wreak havoc on European energy markets. Domestically, inflation was still running at almost four times the Federal Reserve’s target level of 2.0%, worrying consumers and fueling an aggressive monetary policy response. Given all this, it’s not surprising that predictions by professional forecasters of an imminent recession were nearly unanimous.

But this “guaranteed” recession never came. Instead, U.S. labor markets remained strong, consumers proved resilient, and emerging technologies powered stock markets higher.

Comments on Our 2023 Estimates

As always, writing this section proved to be extremely humbling. However, we believe that the only way to remain faithful to the principles that govern our investment philosophy, namely humility and respect for the challenges that are inherent to financial markets, is to be blunt in our assessment of how well we anticipated the year’s developments.

Perhaps not surprisingly, given all of the uncertainty and volatility of the past few years, 2023 forecasts were punctuated by a significant lack of conviction by strategists generally. Indeed, a survey of Wall Street’s pros heading into the year revealed a spread of almost 40% between the highest and lowest forecasts for the S&P 500’s 2023 return, with the same group predicting, on average, the first calendar year decline for the index in decades.2 While the First Command Investment Management Team did expect markets to be up slightly, the magnitude of 2023’s market performance caught us by surprise as well. Let’s review how our other expectations played out for 2023:

- We predicted real economic growth would be positive, but barely. Instead, both of the first calendar quarters grew at an annual rate of over 2%, followed by a 4.9% surge in Q3 – the fastest pace of growth outside of pandemic-related distortions since 2014!

- Considering our more tempered economic growth expectations based on higher borrowing costs, we also projected flat to slightly negative earnings growth in aggregate. While we avoided an actual downturn, earnings appeared to have risen in the low single digit range supported by strong consumer spending and prudent borrowing that took advantage of historically low interest rates in prior years.

- Despite a softer growth outlook, we remained relatively optimistic about the resiliency of the labor markets, acknowledging the ongoing supply/demand imbalance for workers. Even so, as of December 31, 2023, unemployment registered a historically low reading of 3.7%, undershooting the midpoint of our forecast by a full percentage point.

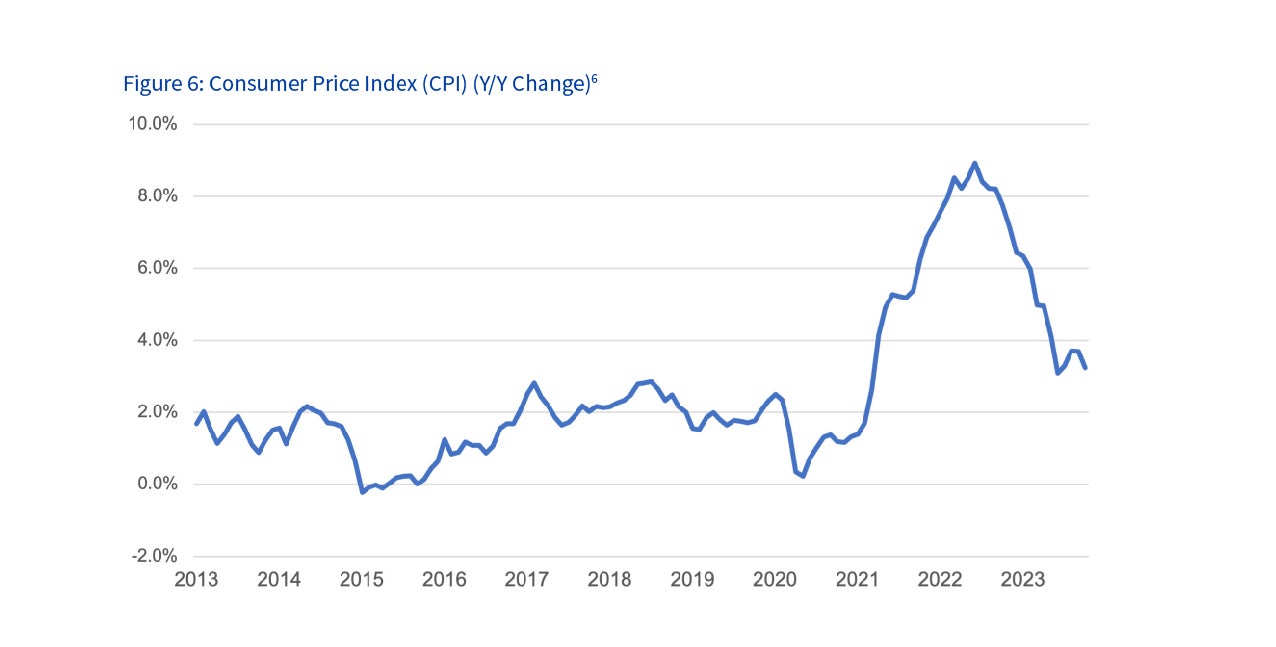

- Inflation was a metric we nailed, having projected a year-end annual rate of 3-4% for the Consumer Price Index. The reading as of December 31, 2023, was 3.1%.

- On a similar note, our view of declining inflationary pressure assumed the Federal Reserve would be able to slow their path of rate increases, which proved to be accurate. While the market on average was looking for rate cuts by year-end3, we anticipated resolve from policymakers and another two or three increases of 0.25% each. We were right directionally, but the Federal Reserve actually raised the discount rate by 0.25% four times in 2023.

- The Fed’s path for interest rates influenced other rates as well, which actually validated our expectation for the 10 Year Treasury rate. We assumed the yield would end the year under 4%, and it finished at 3.9%.

All in all, our misses were relatively small, and our collective outlook was close enough to keep us on the right side of the markets. As such, we correctly chose to keep clients fully invested in 2023, emphasizing quality in portfolios as a hedge against the unknown instead of moving into cash, a mistake made too often by those trying to time the market.

Looking Ahead to 2024

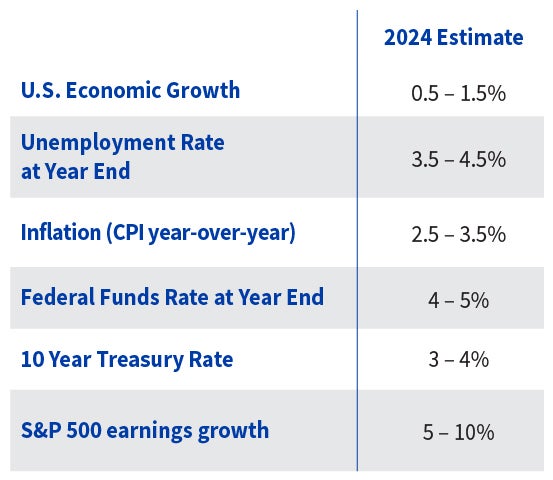

Our outlook for the economy and financial markets, summarized in the table below, reflects our belief that the U.S. economy will continue to expand in 2024, albeit at a slower pace than in 2023:

Economic Growth

Economic growth can be dissected into a few major components, none of which are more important than consumer spending. Given that this segment accounts for nearly 70% of the U.S. economy, it’s reasonable to conclude it will play a leading role in shaping growth in the year ahead. In 2023, consumption was supported by solid income growth and a willingness to spend excess savings accumulated during the pandemic. However, we expect these drivers to weaken in 2024 for a couple of reasons:

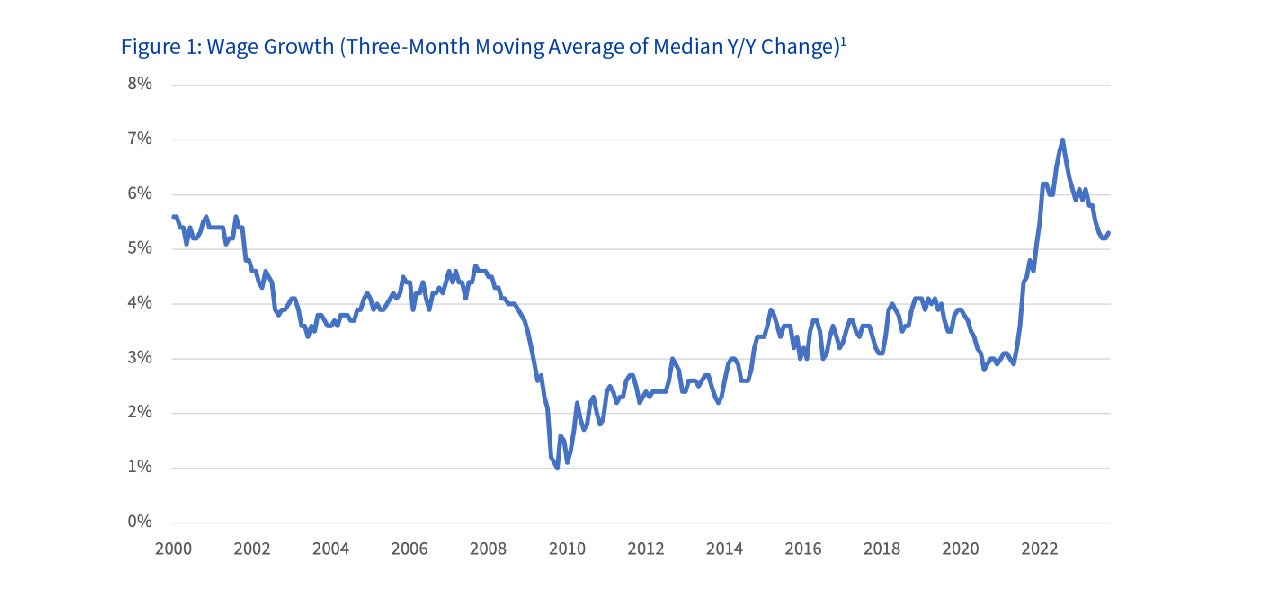

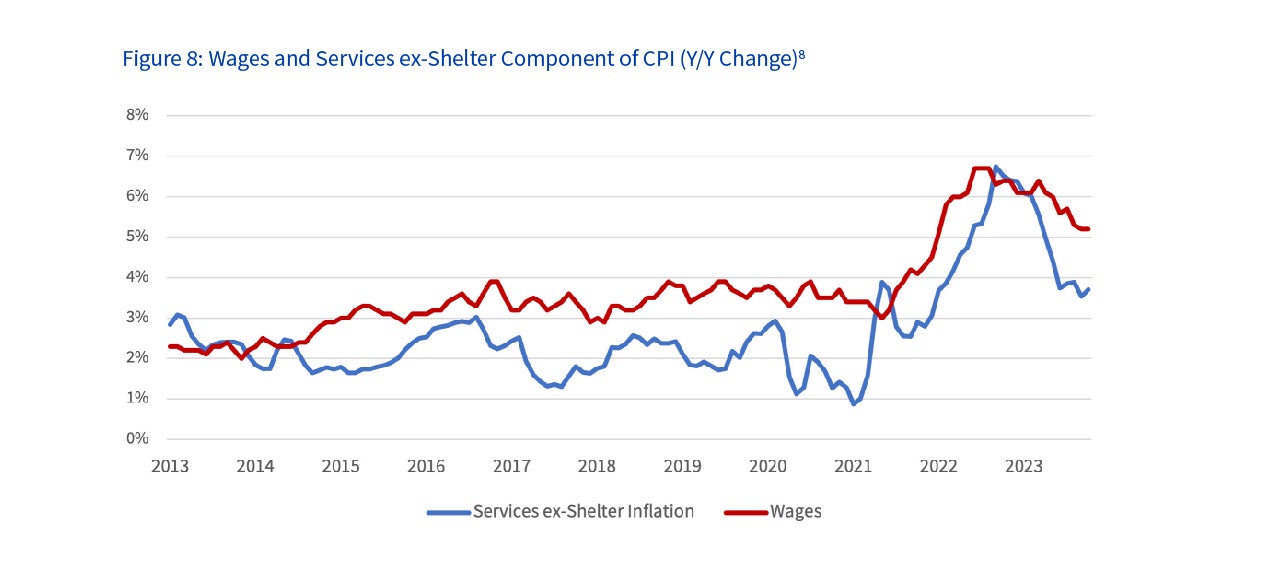

- First, a tight labor market helped to propel wage growth higher in 2021 and 2022, but we expect this surge to fade as the labor market’s strength continues to normalize. In fact, we may already see this beginning to play out. Continuing jobless claims, for example, are starting to move higher, suggesting the unemployed are having a tougher time landing their next job. Wages could be reflecting this as well. After peaking at 7.0% in August 2022, wages are now growing by about 5.3% year-over-year ― still a healthy level, but this is likely to continue moving lower as the demand for labor softens.

- Additionally, during the early part of the pandemic, the combination of trillions of dollars in fiscal stimulus and fewer opportunities to spend allowed households to accumulate a large cushion of savings. Since mid-2021, however, consumers have been drawing on these resources to augment their spending, which is reflected in a declining savings rate that has now fallen beneath pre-pandemic levels. With this stockpile now largely depleted, we expect the savings rate to move higher, acting as a drag on consumption.

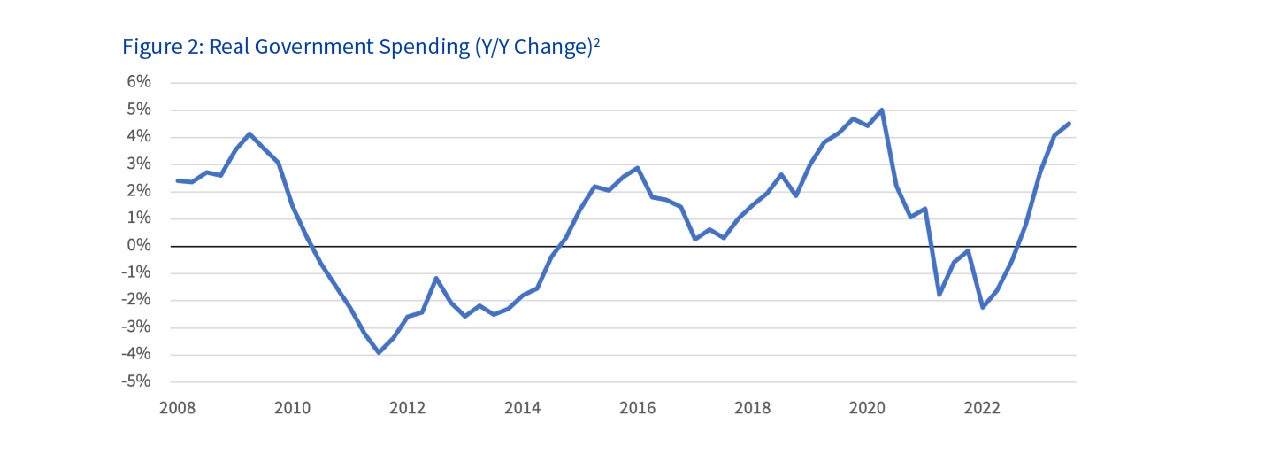

Next, consider government spending, which makes up another 17% of the U.S. economic pie. Like consumer spending, this was an important contributor to growth in 2023, as spending associated with pandemic-era fiscal policy initiatives, such as the Infrastructure Investment and Inflation Reduction Acts, helped to drive economic expansion. However, this stimulus also came at the expense of a worsening federal deficit, which will be hard to repeat in 2024. Inflation fears, a more skeptical Treasury bond market, and increased partisanship during an election year have raised the bar for new spending initiatives just as the impact from previous programs loses steam.

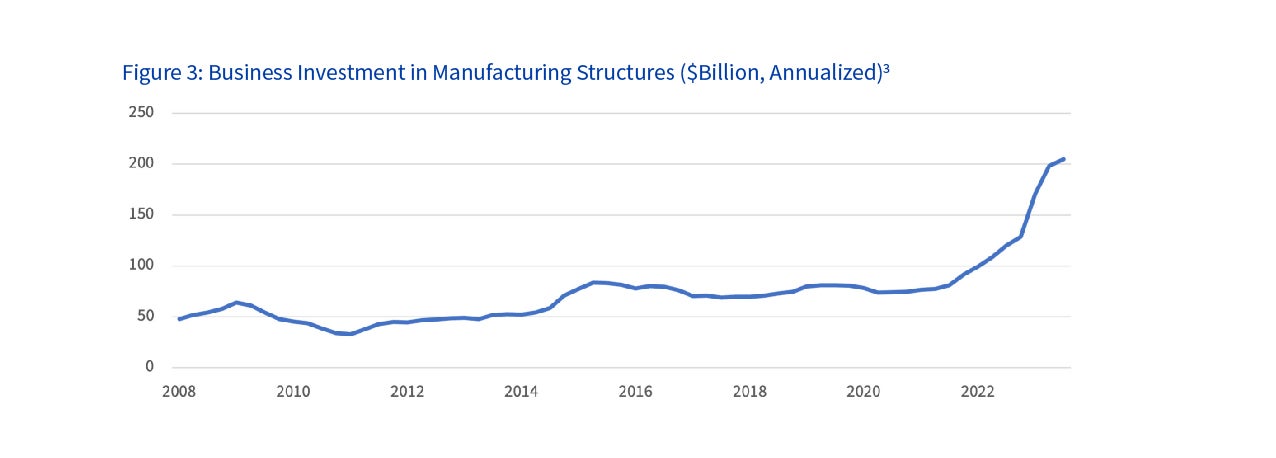

Beyond consumer and government spending, business investment represents most of the remainder of the economy. This segment rose 3.7% year-over-year through the third quarter of 2023, thanks in part to a steep increase in spending on manufacturing facilities. A major driver of this flood of capital expenditure was the CHIPS Act, which incentivized semiconductor companies to relocate some of their production from Asia and other parts of the world back to the U.S. For context, prior to the passage of the act in the summer of 2021, annual investment in manufacturing structures was about $80 billion; the current annualized rate is over $200 billion. As with many of 2023’s drivers, though, this surge is starting to level off, suggesting another loss of momentum heading into 2024.

Beyond policy incentives, business spending is also influenced by the cost and availability of financing. As just about everyone has noticed, rising government rates have pushed market yields higher, including those that set the base for corporate borrowing. This is making it tougher for projects under consideration to clear the hurdle rate of return needed to greenlight an investment in them. At the same time, banks have tightened lending standards in response to losses in their securities portfolios (as higher rates have greatly reduced the value of the bonds they own) and rising delinquency rates on auto and credit card loans. Collectively, we believe these factors will restrain capital expenditure growth in 2024.

Putting the different pieces together, it seems likely that economic growth will slow in 2024, as all major parts of the economy are experiencing at least some pressure relative to the last year. That being the case, remember that it is still the consumer that sits in the driver’s seat, and nothing is more important to continued consumer spending than the employment landscape, which has proven very resilient.

Employment

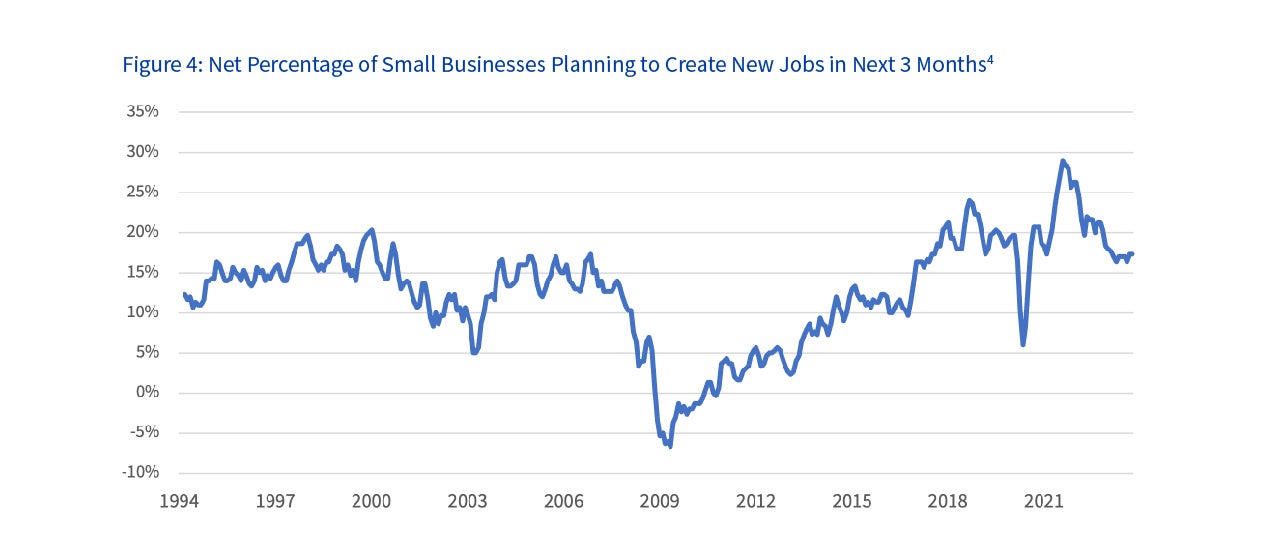

One of the happier surprises of 2023 was that more than 2 million new jobs were created over the course of the year. However, the unemployment rate still rose slightly because the labor force grew at an even faster rate as people sidelined during the pandemic began looking for jobs. Nonetheless, the outcome was much better than most economists were forecasting. Even the Federal Reserve was too pessimistic, expecting unemployment to increase to 4.6%, well above the number as of December 31, 2023, of 3.7%. Casting our eye to 2024, we remain optimistic that the unemployment rate can stay low. Various surveys indicate that hiring plans remain robust. In fact, a recent report from the National Federation of Independent Business (NFIB) revealed that a net 17% of business owners plan to increase hiring in the months ahead, which compares favorably to the long-term average of 13%. Additionally, there are still a lot of job openings, with 1.3 positions available for every unemployed person. These numbers suggest to us that, on the whole, demand for labor remains solid.

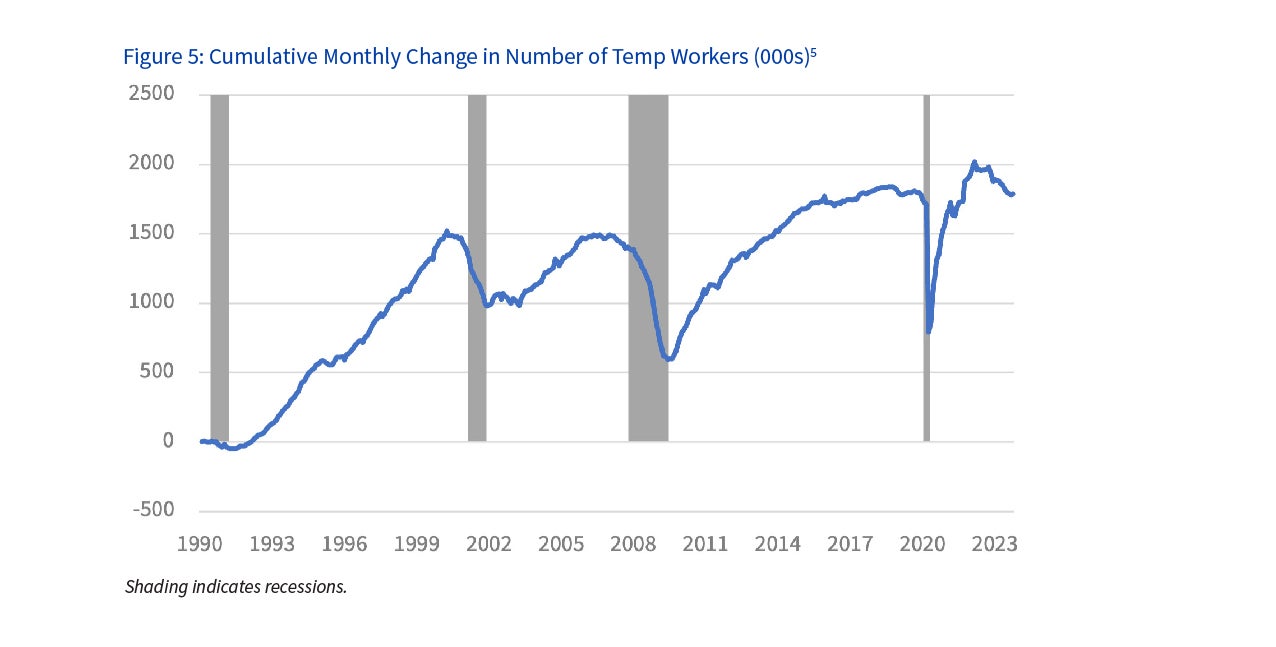

We do not want to be overly sanguine, though, as there are some warning signs emerging for job seekers. For instance, the number of temporary workers has been falling in recent months, which is sometimes a harbinger of tougher times ahead as companies tend to cut temporary positions before their permanent roles. Conflicting messages like these are difficult to interpret, particularly in the wake of a pandemic that fundamentally changed the way we work, and the mixed signals contribute to what we view as an elevated level of uncertainty surrounding the outlook for the economy.

Inflation

What a difference a year makes. In early 2023, we wrote that the impact of inflation had “rippled through global financial markets, driving stock and bond prices lower.” Since then, though, the script has flipped, with steadily slowing inflation helping to drive stocks higher. In the coming months, we anticipate more benign inflation, which should offer ongoing support for financial asset prices.

Consumer spending generally falls into one of three categories – goods, shelter or services. Each of these groups experienced significant inflation over the last few years, but often at different times and for different reasons.

- Goods prices spiked early in the pandemic in response to supply chain disruptions, along with a shift to spending on merchandise, particularly for the home, rather than services such as hotels, restaurants, and entertainment venues, which were mostly shuttered. These dual shocks to both supply and demand caused prices to soar at an annual rate of over 12% by early 2022. Since then, however, supply chains have been repaired or rebuilt elsewhere, while spending patterns have normalized. As a result, goods inflation has faded entirely.

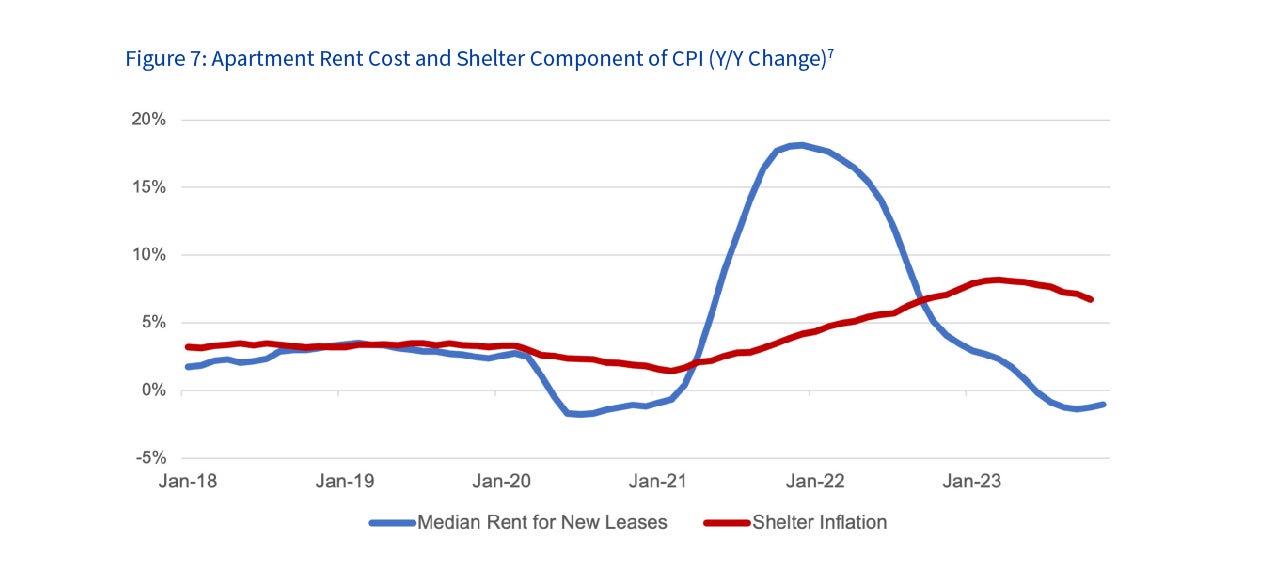

- The shelter component of inflation is tied to rental prices for homes and apartments, but the way it is measured causes it to lag behind changes in the housing market because rental prices only reset as leases expire. At the outset of the pandemic, rock-bottom mortgage rates, combined with the flexibility to work remotely and a desire by many to live elsewhere, helped push housing prices sharply higher. Just as with goods, though, the factors that drove prices higher have reversed – mortgage rates rose steeply in 2022 and much of 2023 while workers began returning to the office. This drove home prices lower while rental prices are just now beginning to fall. As such, shelter inflation should steadily decline as old contracts expire and new ones are signed.

- Finally, the biggest expense for most service businesses is labor, and a scarcity of willing workers during the pandemic propelled wage growth to the highest rate in decades. This, in turn, forced businesses to raise their prices to earn a profit. Over the last year, however, a tight labor market has begun to soften. As a result, wage growth has slowed, and this has flowed through to services inflation. In the months to come, we expect the labor market to soften further which should continue to push services inflation lower.

Collectively, the factors that drove inflation across goods, shelter, and services are different, but in a sense, the stories are all the same. For a time, the pandemic created imbalances in supply and demand across the economy that forced prices higher, but as the global economy healed, the scales began to balance again, and inflation fell. As this process continues to play out, we believe inflation will continue to fall.

Rates

With inflation abating alongside one of the most aggressive tightening cycles in U.S. central bank history, the Fed may have the leeway to cut short term rates in 2024 – but probably not as soon or by as much as many seem to think. In the last couple of months of 2023, investors’ expectations for rate cuts rose in response to a series of benign inflation readings. As of the turn of the year, investors are ascribing more than an 80% probability of at least one 0.25% cut before April, and a greater than 100% chance of at least 0.75% in cuts before the middle of the year. While this consensus view may be in the right neighborhood, cuts could be skewed later for a couple of reasons.

First, as noted above, wage pressure and services inflation are still elevated, albeit slowing, and in the near-term this is likely to keep the Fed on guard against an unwanted resurgence in prices. Second, the Fed does not want to risk losing credibility as an inflation fighter. One of the most important underpinnings of our economy is a belief among its participants that our central bank will maintain price stability over the long term. Without this conviction, inflation would likely be higher and more volatile and our economy less efficient. During the pandemic, this faith was tested when the Fed incorrectly assumed inflation was likely to be “transitory.” It ultimately regained some lost credibility and kept price expectations anchored with one of the steepest interest rate hiking cycles in its history. Having been burned once already, we believe the Fed is more likely to play it safe with inflation and stay the course a little longer by deferring rate cuts until later in the year.

Although the Fed does not set longer term yields, it does influence them. More specifically, lower short rates increase the relative attractiveness of longer-dated securities and induce investors to rotate into this segment of the fixed income market, which helps push prices up and yields down. This typically begins to occur as soon as the Fed finishes hiking rates, but in advance of any official rate cut. In fact, after the final rate hike in the last several cycles, the yield on the 10 year Treasury note fell a little under 1% on average before they actually cut rates, and then further once rate cuts actually began. A similar outcome this time around, which we believe is reasonable, would likely result in a yield on the 10 year Treasury note in the 3% to 4% range at the end of 2024.

Stock Markets

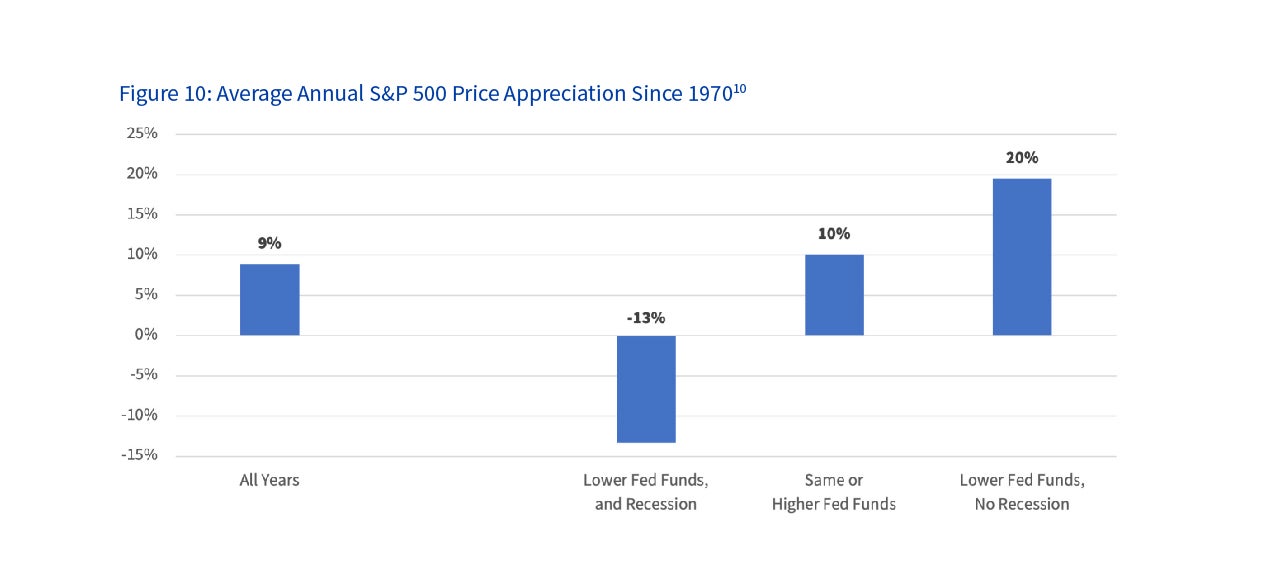

Besides supporting long-term bonds, lower short-term rates should also help boost stocks. Since 1970, the average gain for the S&P 500 in years marked by a falling Fed Funds rate, but no recession, was 20%. This is much higher than the 9% average for all years. Of course, the other side of the coin is that, in the eight years when falling rates were accompanied by a recession, stocks fell 13%. Clearly a lot is riding on this outcome, but if our base-case outlook for a slowing but still expanding economy in 2024 is correct, we believe the prospects for stocks are still positive.

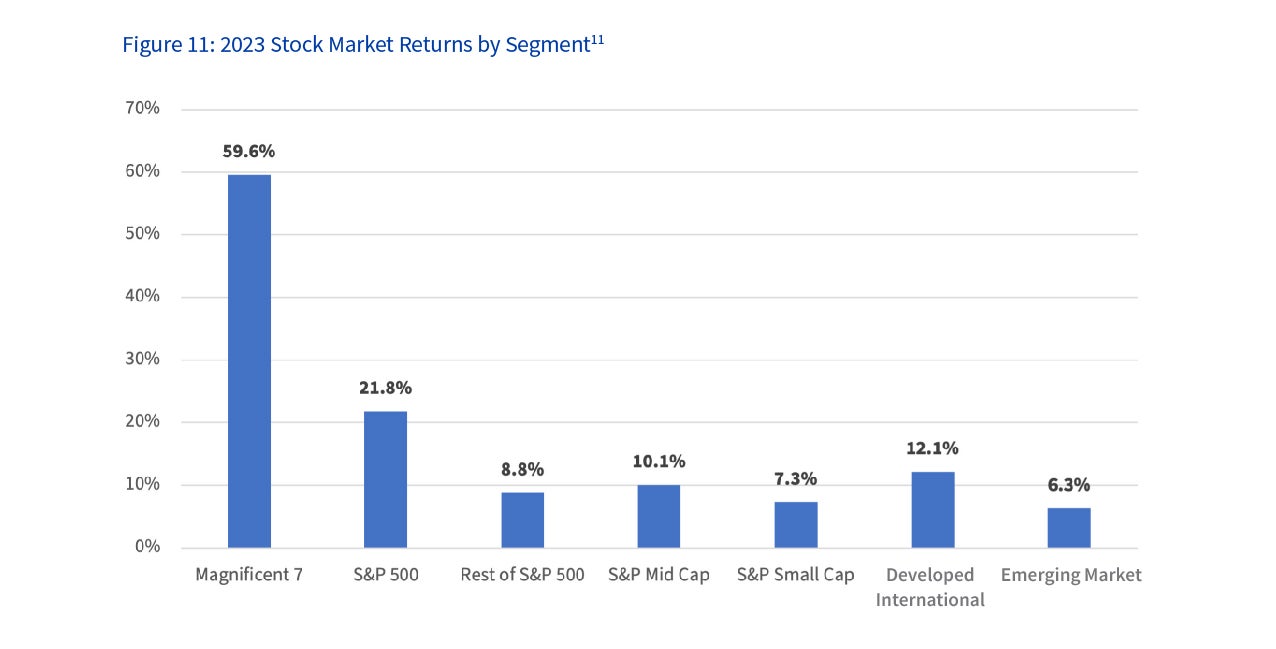

We also see opportunity for stocks outside the U.S. large cap universe (represented by the S&P). In 2023, a handful of very large, tech-oriented companies, referred to as the “Magnificent 7,” powered the S&P 500 to outsized gains. This surge was fueled by excitement over artificial intelligence and strong earnings trends that appealed to cautious investors. If we move through 2024 and recession fears continue to recede, we believe investors could be more inclined to venture outside the relative safety of these mega-cap names into more neglected and less expensive areas of the market, like international and/or smaller companies.

The First Command Investment Philosophy

At First Command, we value time in the market versus attempting to time the market, accept volatility as an inherent short-term risk for stock investors, and use it to our advantage to improve market returns. Our Advisors are trained to utilize the wide range of investment options we offer, to ensure that our clients’ investments are aligned with their financial plan and, just as importantly, to keep them on track through inevitable periods of volatility. Experience has taught us that volatility can actually improve financial outcomes, particularly when addressed via a well-designed, globally diversified portfolio that is aligned with your financial plan, investment time horizon, and risk tolerance. If you haven’t met with your Financial Advisor recently to review your plan and assess your portfolio, we encourage you to do so at your earliest convenience.

Thank you for the confidence you have placed in First Command.

Figure Sources

- Source: Federal Reserve Bank of Atlanta.

- Source: Bureau of Economic Analysis.

- Source: Bureau of Economic Analysis.

- Source: National Federation of Independent Business.

- Source: Bureau of Labor Statistics.

- Source: Bureau of Labor Statistics.

- Source: Bureau of Labor Statistics and Apartment List.

- Source: Bureau of Labor Statistics and Federal Reserve Bank of Atlanta.

- Source: The Federal Reserve.

- Source: Standard and Poor’s and First Command.

- Source: Standard and Poor’s, BlackRock and First Command.

Footnotes

1 Source: Refinitive/LSE Group as of December, 2023.

2 Source: Bloomberg S&P 500 Forecasts from Strategist as of December, 2022.

3 Source: Bloomberg World Interest Rate Probability as of December, 2022.

The information in this report was prepared by John Weitzer, CFA, Chief Investment Officer, Matt Wiley, CFA, Vice President of Investment Management, and Dan Murphy, CFA, Investment Strategist of First Command. Opinions represent First Command’s opinion as of the date of this report and are for general informational purposes only and are not intended to predict or guarantee the future performance of any individual advisor. All statistics quoted are as of the date of this publication, unless otherwise noted. First Command does not undertake to advise you of any change in its opinions or the information contained in this report. This report is not intended to be a client specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. Should you require investment advice, please consult with your financial advisor. Risk is inherent in the market. Past performance does not guarantee future results. Your investment may be worth more or less than its original cost. Your investment returns will be affected by investment expenses, fees, taxes and other costs.

©2024 First Command Financial Services, Inc. parent of First Command Brokerage Services, Inc. (Member SIPC, FINRA) and First Command Advisory Services, Inc. Securities products and brokerage services are provided by First Command Brokerage Services, Inc., a broker-dealer. Financial planning and investment advisory services are offered by First Command Advisory Services, Inc., an investment adviser. A financial plan, by itself, cannot assure that retirement or other financial goals will be met.

First Command does not provide legal or tax advice, and this report does not contain any legal or tax advice. Should you require legal or tax advice specific to your situation, you should consult with an attorney or qualified tax advisor. The information provided to you herein is provided for informational purposes only, is not intended to be tax or legal advice, and should not be used for the purpose of avoiding tax-related penalties under the Internal Revenue Code.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.