Since February, President Trump and his administration have engaged in aggressive tactics to renegotiate trade agreements. During his presidential campaign, Trump pledged to renegotiate “bad” trade deals for the benefit of U.S. citizens. His chosen tactic entails threatening other countries with tariffs 1 in order to get them back to the table so he can “get a better deal.” In his book, “The Art of the Deal”, President Trump describes his negotiating style as “an initial series of unreasonable demands and heated rhetoric followed by unexpected compromises.” 2

The U.S. equity markets did not respond well to this particular style of negotiation (along with a concurrent rise in interest rates). The S&P 500 began the year at 2,697 and peaked at 2,872 on January 26 th (a strong advance of 6.5%). We then experienced a 291 point drop, representing a 10.1% correction, between January 26 th and February 8 th. Since then, the S&P 500 index has acted like a yo-yo.

Why has this style of negotiation and choice of tactics spooked the markets? Part of the answer can be found in U.S. history. The enactment of the Smoot-Hawley Tariffs in 1930, which imposed tariffs on over 20,000 imported goods, arguably contributed to the Great Depression. 3 The line of thought here is that if tariffs are imposed and trade wars ensue, our current economic expansion (currently 106 months in duration and now the second longest on record) will end and a recession and bear market will begin. The markets hate uncertainty and these tactics have surely increased uncertainty.

How will this play out? There seem to be two potential paths.

Path #1 – If, in the aggregate, President Trump negotiates more favorable trade agreements and secures economically valuable concessions, then this would bolster U.S. economic growth. Currently, First Command estimates that U.S. gross domestic product (GDP), a measure of economic growth will be between 2.3% and 3% for 2018. This estimate does not include any potential positive impact of successful trade negotiations.

Path #2 – If President Trump's trade tactics trigger a trade war or wars, then this would detract from U.S. economic growth. Assuming a trade war or wars, the question then becomes, “how much?”

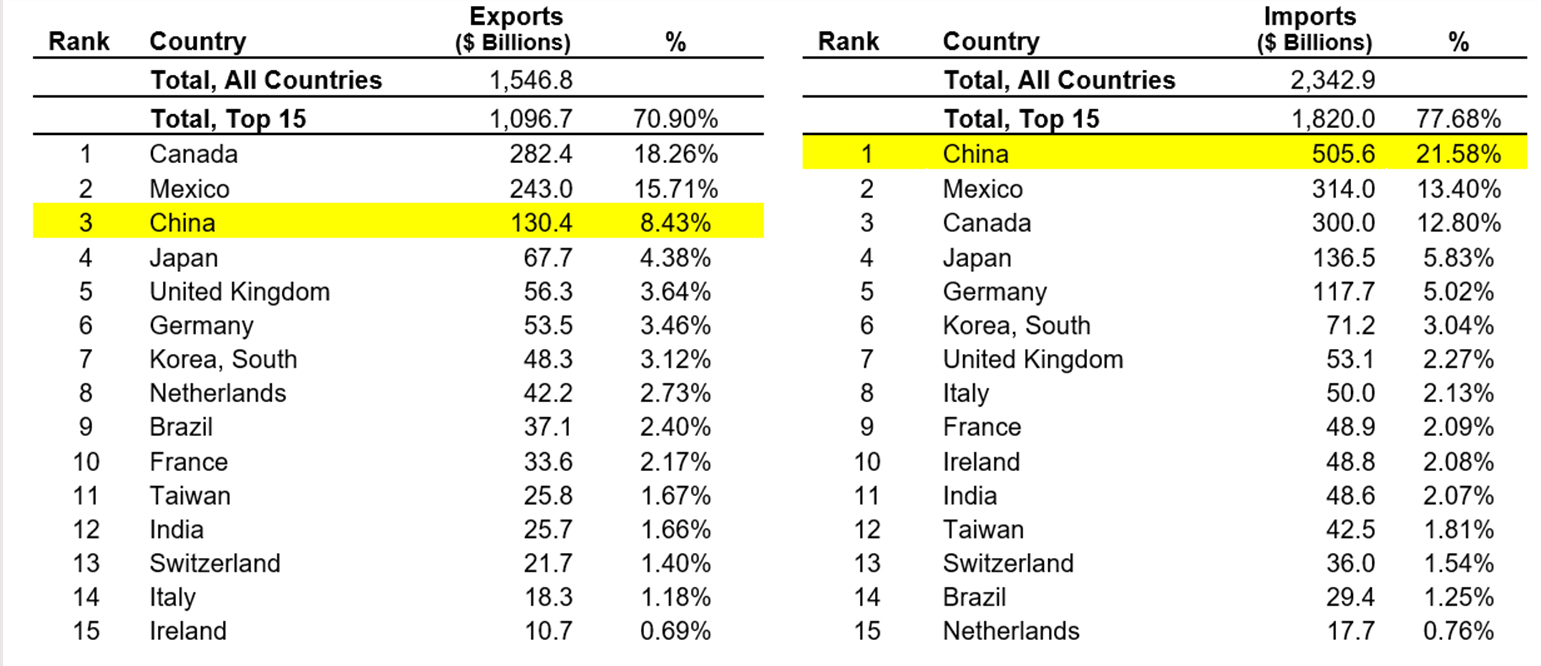

The answer to how much a trade war would negatively impact U.S. economic growth depends on what country or combination of countries get involved. Let's look at the tables below that show the top 15 U.S. trading partners in 2017. This data was taken from the United States Census Bureau 4, which is responsible for tracking U.S. trade.

First, you can see that we import over $2.3 trillion in goods while only exporting $1.5 trillion, an $800 billion difference. Second, because it’s evident that we have a significant trade with countries like Canada, Mexico, China, Japan and the U.K., you can conclude that trade wars with any or all of these countries would have disproportionately negative consequences for U.S. economic growth. A trade war with one or a couple of smaller trading partners like Italy or Ireland, on the other hand, most likely wouldn’t move the needle on U.S. economic growth. Just to put things in perspective, total exports in 2017 represented only about 8% of the $18.6 trillion of total U.S. economic output. 5

Now let’s examine the U.S. and China trade relationship. The U.S. and China represent the two largest economies on Earth ($18.6 trillion and $21.3 trillion, respectively). 6 If a trade war does flare up, there is a higher probability of it being between the U.S. and China. China has been flagrantly stealing U.S. intellectual property (to the tune of $300 billion a year), which is why President Trump is making this negotiation a high priority. It will be important, however, that in his efforts to put pressure on them he does not push too hard. 7

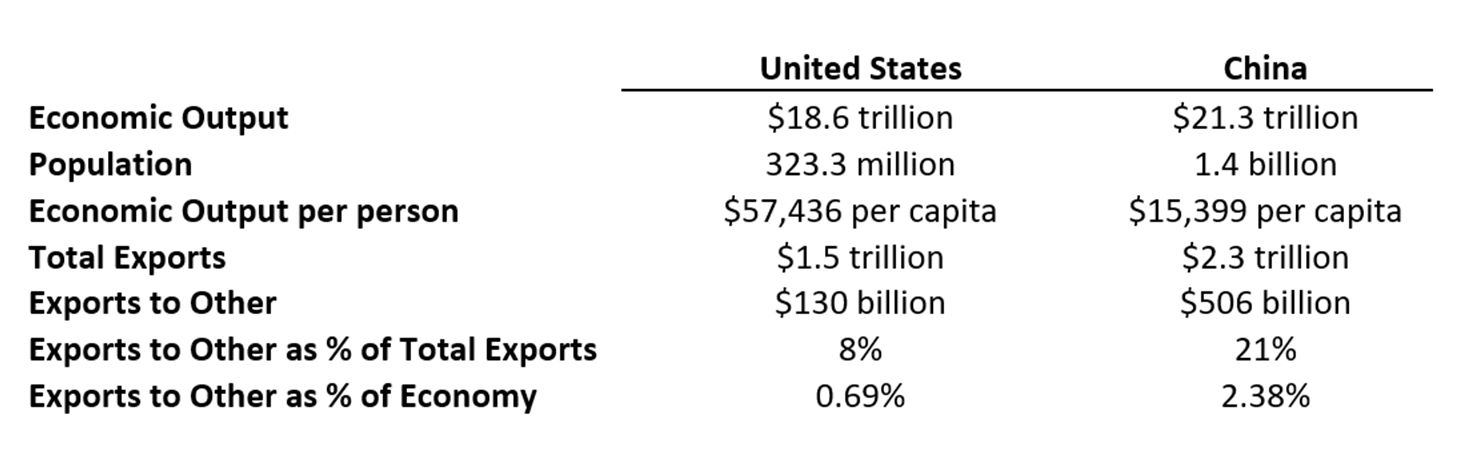

Before we start, let us compare the two countries in the following table 8:

China exports $506 billion of goods to the U.S., which represents 21% of their total exports and 2.38% of their total economic output. The U.S. exports $130 billion of goods to China, which represents 8% of our total exports and 0.69% of our total economic output. Theoretically, the U.S. could slap tariffs on anything over $130 billion of Chinese goods and China could not reciprocate fully. Please note that although China has threatened tariffs on U.S. goods and the U.S. has threatened tariffs on Chinese goods, no tariffs have become effective yet. The diplomatic dance is to threaten first and then give negotiators time to negotiate. According to Jay Bryson, global economist for Wells Fargo, “it appears that China would have more to lose than the United States from an all-out trade war, should one develop.” 9 Dr. Gary Shilling, a well-regarded U.S. economist, states that “in a world of surpluses, the buyer, not the seller, has the upper hand. And the U.S. is the absorber of the world’s excess goods and services for which there are no other major markets.” 10 It appears that President Trump has come to the same conclusion and that he believes he has some leverage to address what appears to be the real issue of intellectual property theft. On April 4 th, he tweeted “[w]e are not in a trade war with China, that war was lost many years ago ... we now have a trade deficit of $500 Billion a year with Intellectual Property Theft of another $300 Billion.[sic]” 11

China may appreciate this sentiment. On April 10, 2018, Chinese President Xi Jinping gave a speech offering several concessions on trade. 12 These concessions included lowering China’s tariffs on imported cars and eliminating the requirement that foreign companies operate in China through Chinese controlled joint ventures. 13 In addition, President Xi provided assurances about protecting intellectual property. 14 President Trump quickly responded to the speech by tweeting, “Very thankful for President Xi of China's kind words on tariffs and automobile barriers...also, his enlightenment on intellectual property and technology transfers. We will make great progress together!” 15

Let me summarize:

- President Trump has adopted an aggressive strategy with regard to global trade by using tariffs to reopen existing trade deals for renegotiation.

- This aggressive approach has greatly increased the volatility of the U.S. equity markets.

- Many investors fear that a fully implemented protectionist trade policy would negatively impact U.S. economic growth and trigger a bear market.

- One outcome would be for the negotiating strategy to bear positive fruit (trade concessions) thus bolstering U.S. economic growth.

- Another outcome would be for the tactic to go too far and trigger a trade war or wars.

- Trade wars with major economic partners would negatively impact U.S. economic growth.

- China has more to lose in an all-out trade war with the U.S.

To the extent the President avoids trade wars and wins some concessions, market volatility should decrease, especially in light of the beginning of the first quarter of the U.S. earnings season, which, as of last Friday, was rather strong. 16 If a trade war develops with one or more minor trading partners, I would expect market volatility to decrease slightly or remain the same. If a trade war develops with a major trading partner, I would anticipate that market volatility would increase.

Here at First Command, we believe that your investment strategy needs to be fully integrated with your long-term financial plan, and that your investment portfolio should not take any more risk than it needs to take in order for you to pursue your financial goals. If you would like to review your portfolio and financial plan to ensure that they properly reflect your goals and risk comfort level, I encourage you to consult your Advisor.

Thank you for taking a look.

John Weitzer, CFA

Chief Investment Officer

The information in this report was prepared by John Weitzer, Chief Investment Officer of First Command. Opinions represent First Command’s opinion as of the date of this report and are for general informational purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. First Command does not undertake to advise you of any change in its opinions or the information contained in this report. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. Should you require investment advice, please consult with your financial advisor. Risk is inherent in the market. Past performance does not guarantee future results. Your investment may be worth more or less than its original cost. Your investment returns will be affected by investment expenses, fees, taxes and other costs.

[1] A tariff is a tax or duty to be paid on a particular class of imports or exports.

It is important to note

that any imposed tariff increases the price of the traded good, and this is generally always absorbed by

the

consumer. In such a way, the tariff almost always ends up being a tax on consumers.

[2] The StrategicView by RiverFront Investment Group, p. 3 (April 16, 2018).

[3] The Tariff Act of 1930, commonly known as the Smoot–Hawley Tariff, was an act implementing

protectionist

trade policies. It was signed into law on June 17, 1930. The act raised U.S. tariffs on over 20,000

imported

goods (

https://en.wikipedia.org/wiki/Smoot%E2%80%93Hawley_Tariff_Act).

The Great Depression started in the United

States after a major fall in stock prices that began around September 4, 1929, and became worldwide news

with

the stock market crash of October 29, 1929. Between 1929 and 1932, worldwide gross domestic product (GDP)

fell

by an estimated 15%. Unemployment in the U.S. rose to 25% (

https://en.wikipedia.org/wiki/Great_Depression).

[4]

https://www.census.gov/foreign-trade/statistics/highlights/top/top1712yr.html.

[5] 2018 Index of Economic Freedom, The Heritage Foundation (

www.heritage.org/Index).

[6] Same. As measured by “purchasing power parity”.

[7] According to Brian Wesbury, Chief Economist of First Trust Advisors, “China, in particular,

which has

been leveraging access to its huge market to essentially steal foreign companies’ trade secrets and

intellectual

property. It has a long-term track record of not respecting patents or trademarks. In theory, letting

China

into the World Trade Organization was supposed to stop this behavior. But no company wants to bring a WTO

case

against China when it thinks that China would respond by ending its access to their markets and letting

in

competitors who are more willing to be exploited.” “Thoughts on Trade” by Brian Wesbury, Chief Economist

of

First Trust Advisors, p. 1 (April 16, 2018).

[8] 2018 Index of Economic Freedom, The Heritage Foundation (

www.heritage.org/Index).

[9] “How Costly Would a Full-Blown Trade War Be?”, p. 2, by Jay H. Bryson, Wells Fargo Securities

(April 5,

2018).

[10] A. Gary Shilling’s INSIGHT Economic Research and Strategy, Volume XXXIV, Number 3, p. 27

(March 2018).

[11]

www.twitter.com (April 4, 2018, Donald J. Trump).

[12] The StrategicView by RiverFront Investment Group, p. 1 (April 16, 2018).

[13] Same.

[14] Same.

[15]

www.twitter.com (April 10, 2018, Donald J. Trump).

[16] As of April 19, 2018, 73 of 500 of the S&P 500 companies reported earnings for the first

quarter

2018. 77% exceeded analyst expectations, 11% matched, and 12% came in below. Reported earnings are

surprising

to the upside. Earnings and revenue growth are robust. S&P 500 Earnings Scorecard, Thomson Reuters

(April

19, 2018).